Notes: Quoted from the web site of Japan Financial Services Association as of Oct. 2023.

History of money lending industry in Japan

More than 30 years

ago, there was the times when there were nearly 29 times as many money lenders

nationwide as there are now, and it was even said that there were as many soba (noodle)

shops as there were. There are some money lenders that were lack of awareness of legal

compliance, and the troubles they caused had been highlighted, and the image of the

industry as a whole had been tarnished. The impression of the industry from that time

remains deep-rooted in everyone's minds.

However, those impressions are a thing

of the past.

In fact, the environment of the moneylending industry has changed

completely due to the revision of the Moneylending Business Act in June 2010.

The

revision to the Money Lending Business Act have made it impossible for unqualified

people to enter the money lending industry, and systems have been put in place to

prevent consumers from borrowing too much.

Moreover, Japan Financial Services

Association, a self-regulatory body for the industry, was newly established to set its

own rules and instruct its member money lenders to comply with laws and voluntary rules

through audits and other means.

Now that laws and regulations are in place and money

lenders are becoming more aware of legal compliance, the money lending industry no

longer has the image it used to have.

Background of revision of Money Lending Business Act

The Money Lending Business Act was revised and promulgated in December

2006 to deal with the increasingly serious problem of multiple debts.

The multiple

debts problem was caused by high interest rates, excessive lending, ease of borrowing,

repayment schedule with no interest burden, and lack of financial knowledge and planning

on borrowers. The law was revised to take drastic and comprehensive measures to address

the problem of multiple debts.

The contents of the revision are divided into

optimizing the money lending industry, suppressing excessive lending, optimizing the

interest rate structure, strengthening countermeasures against loan sharks, and

government-wide efforts to address the problem of multiple debts, to prevent a sudden

impact on borrowers. The law was implemented in four stages over a period of about three

and a half years after its promulgation, as it required time for lenders to prepare

their systems.

In addition to eliminating unqualified lenders, the revision placed

emphasis on improving and streamlining the operations of money lenders, and positioned

money lenders as important players in the financial market.

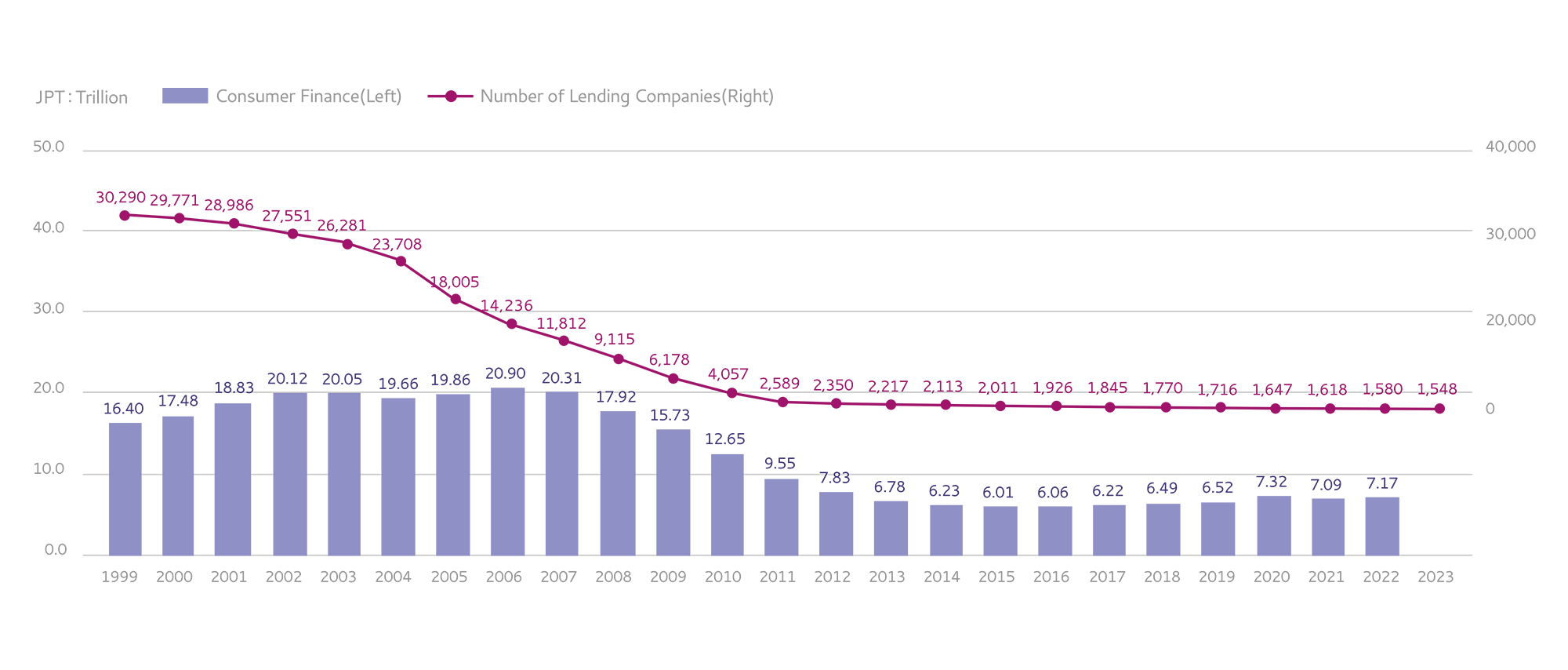

Historical Lending Market Tendency

As shown below table, consumer finance outstanding drop to 1/3 and number of players drop to 5% from the peak.

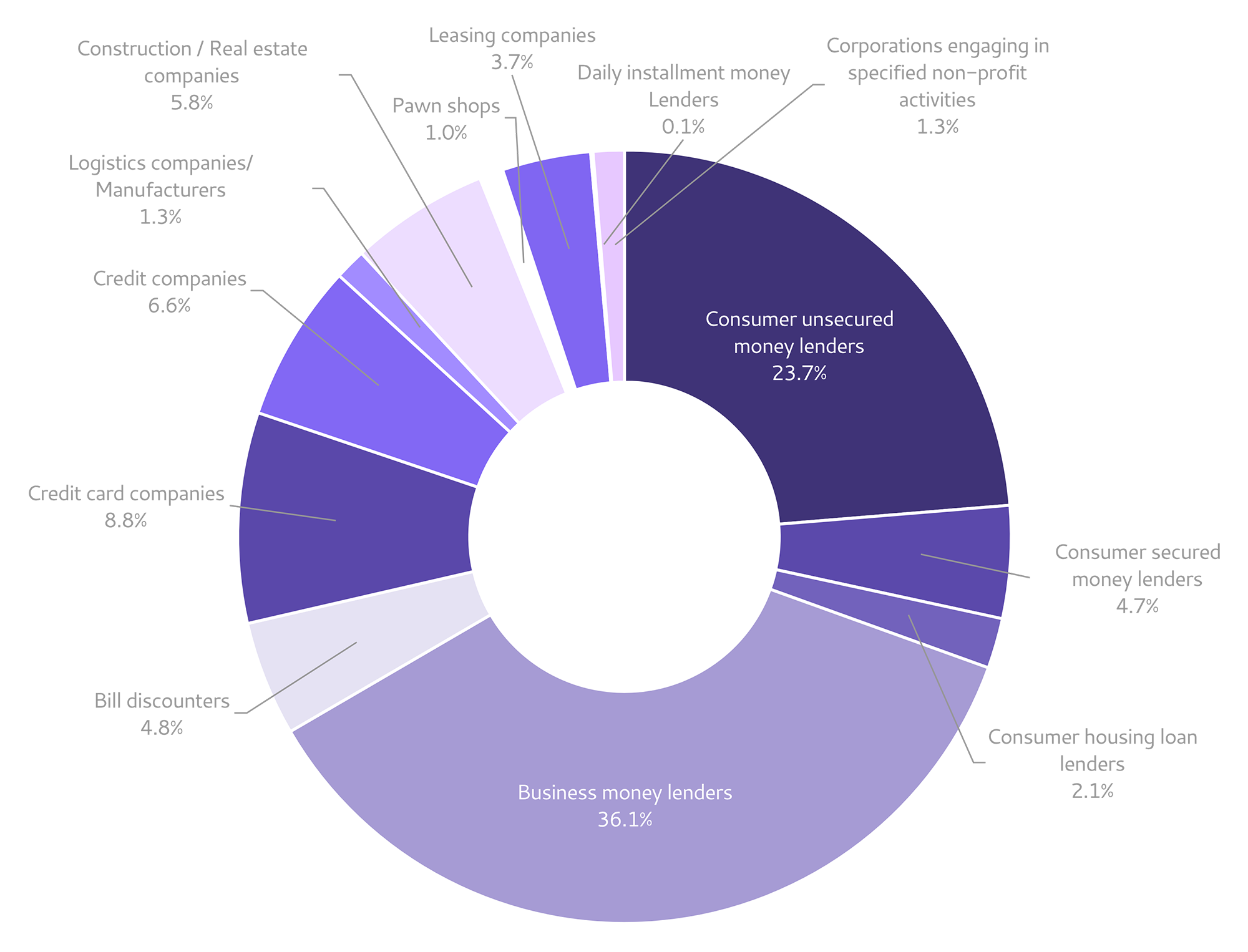

Diversified money lenders that support people's lives and business activities

Money lenders have a variety of business types and business forms. There are over 1,600 money lenders across the country, each with their own characteristics to meet the various urgent financial needs of general consumers (individuals) and businesses.

Many people get the benefits from money lending services.

Japanese population aged 20 and over is 104.87 million. Of these, 10.16

million people use money lending services.

- One in ten people uses money lending

services.

- On average, people borrows from 1.5 companies.

- The average borrowing

amount per contract is 574,000 yen. (For unsecured, unguaranteed loan, 540,000 yen)